Understanding what a deductible is and how it works is crucial for anyone who wants to manage their finances wisely and avoid unexpected expenses. Whether you’re buying health insurance, auto insurance, or any other type of coverage, grasping the concept of a deductible will empower you to make informed decisions and protect yourself from unforeseen financial strain. Curious about how this piece of the insurance puzzle fits into your financial plan? Let’s break it down.

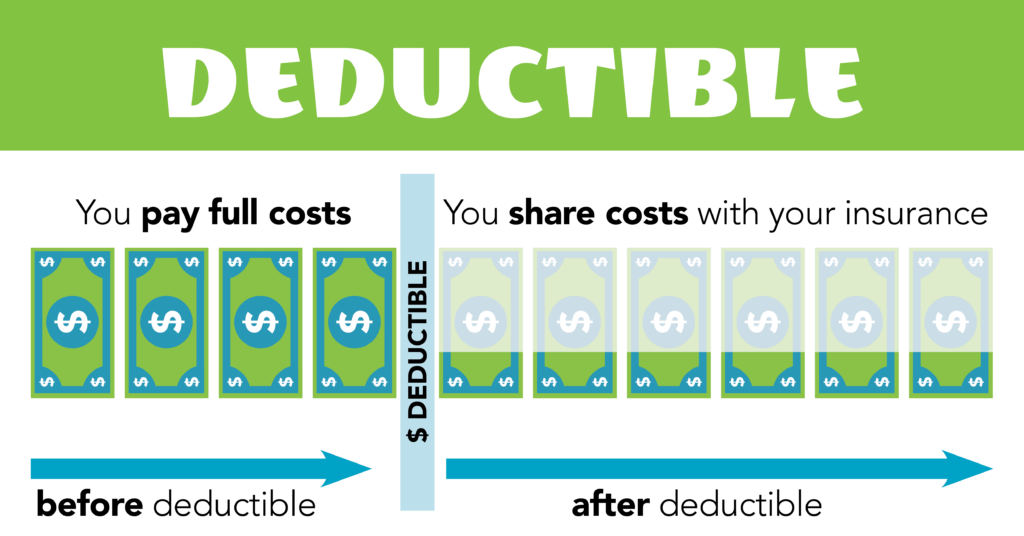

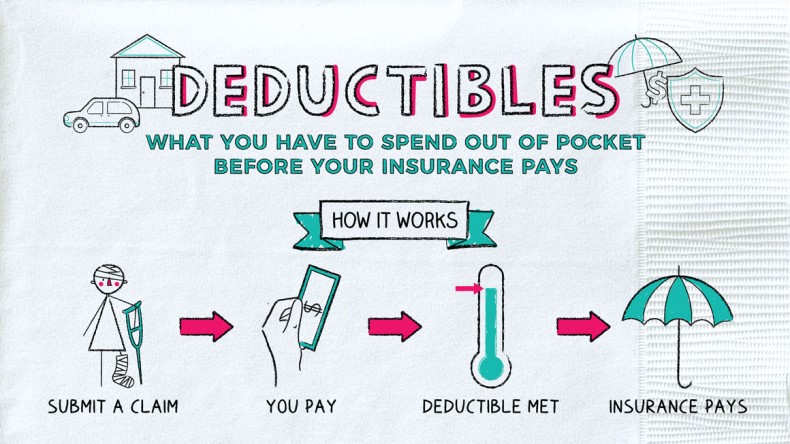

A deductible is a specified amount of money that you must pay out of pocket before your insurance coverage kicks in. Deductibles are commonly used in various types of insurance, such as auto insurance, homeowners insurance, and health insurance.

In insurance, a deductible serves as a way to share the financial risk of an event between you and your insurance company. By agreeing to pay a deductible, you are taking on a portion of the risk of a potential loss or damage to your property, and your insurance company agrees to cover the remaining costs beyond the deductible amount.

How Deductibles Work When you purchase an insurance policy, you will typically have the option to choose a deductible amount. This amount is often a fixed dollar amount, such as $500 or $1,000. In some cases, you may be able to choose a percentage-based deductible, such as 1% of the value of your home.

Once you have selected your deductible amount, it will be applied to any claim you make against your policy. For example, if you have a $1,000 deductible on your homeowners insurance policy and you file a claim for $5,000 in damages to your home, you will be responsible for paying the first $1,000 out of pocket. Your insurance company will then cover the remaining $4,000.

Different Types of Deductibles There are several different types of deductibles that you may encounter in insurance policies. Some of the most common include:

- Standard Deductibles: This is the most common type of deductible, where a fixed dollar amount is applied to each claim.

- Percentage Deductibles: This type of deductible is based on a percentage of the total value of the property insured. For example, if you have a home with a total insured value of $500,000 and a 2% deductible, you would have to pay the first $10,000 of any claim.

- Split Deductibles: This type of deductible separates different types of claims into separate deductibles. For example, a homeowners insurance policy may have one deductible for wind and hail damage, and another deductible for all other types of damage.

- Zero Deductibles: Some insurance policies may offer a zero deductible, where the policyholder is not required to pay anything out of pocket before insurance coverage kicks in.

Choosing the Right Deductible Choosing the right deductible amount for your insurance policy can be tricky. A higher deductible will typically result in a lower monthly premium, but it also means that you will have to pay more out of pocket if you need to file a claim. On the other hand, a lower deductible will result in a higher monthly premium but less out-of-pocket expense if you file a claim.

When selecting a deductible, it’s important to consider your personal financial situation and your overall level of risk. If you have a significant amount of savings or assets, you may be able to afford a higher deductible. If you’re on a tight budget, a lower deductible may be more appropriate.

In conclusion, understanding deductibles in insurance is essential for anyone who wants to make informed decisions about their coverage. By knowing how deductibles work, the different types of deductibles, and how to choose the right deductible for your needs, you can ensure that you have the appropriate level of coverage for your budget and risk tolerance.

Keywords: Deductible, Insurance, Coverage, Policyholder, Premiums, Claims, Comprehensive, Collision, Liability, High-deductible

One of the things that sets Intrinsic Insurance apart is our commitment to our customers. We believe that insurance should be easy to understand and easy to use, and we strive to make the process as smooth and stress-free as possible. Our agents take the time to get to know our customers and their unique needs, so we can provide personalized coverage that meets their specific requirements. Over time, we’ve earned a reputation for exceptional customer service and expertise in the insurance industry, real estate, and construction. We’re proud to have a team of experienced agents who are dedicated to providing our customers with the highest level of service and support. Our agents are knowledgeable, friendly, and always available to answer questions or help our customers file a claim.

One of the things that sets Intrinsic Insurance apart is our commitment to our customers. We believe that insurance should be easy to understand and easy to use, and we strive to make the process as smooth and stress-free as possible. Our agents take the time to get to know our customers and their unique needs, so we can provide personalized coverage that meets their specific requirements. Over time, we’ve earned a reputation for exceptional customer service and expertise in the insurance industry, real estate, and construction. We’re proud to have a team of experienced agents who are dedicated to providing our customers with the highest level of service and support. Our agents are knowledgeable, friendly, and always available to answer questions or help our customers file a claim.